Company Incorporation Singapore & Funding Options

Singapore is renowned as an advanced business hub of the Southeast Asia. The country prefers trade economy. By virtue of its geographical location, planning and lots of hard work, it has come up as the Entrepot linking the East and West. It continues to attract the foreign investors and the business owners who are eager to do their company incorporation Singapore.

Singapore is renowned as an advanced business hub of the Southeast Asia. The country prefers trade economy. By virtue of its geographical location, planning and lots of hard work, it has come up as the Entrepot linking the East and West. It continues to attract the foreign investors and the business owners who are eager to do their company incorporation Singapore.

Is it fashionable to Start a Business in Singapore?

The country offers one of the lower tax rates to the corporate, and individuals. This has attracted thousands of foreign companies, a large majority of which are MNCs and SMEs, to its shores. A number of these companies have entered Singapore market to capitalize on the opportunities present in the emerging markets of Asia.

A company incorporation in Singapore enables these companies to keep in touch with the 2.4 billion prospective customers that are inhabiting Asia. However, starting a business in Singapore means facing stiff competition before achieving business growth. The local and foreign individual entrepreneurs & the companies have options in business structures they can use to start a company in Singapore.

Setting Up a Company in Singapore

A) For Singaporeans & Local Companies

In Singapore, an individual (local as well as foreign) above the age of 18 years can opt for company incorporation Singapore. According to the norms, the individual should not have history of bankruptcy, etc. The local corporate entities can also opt for Singapore business formation.

The individual entrepreneur or a company can choose one of the following business structures for their Singapore company registration. They need to apply to the ACRA (Accounting and Corporate Regulatory Authority) which acts as the Company Registrar of Singapore.

- Private Limited Company (Pte Ltd)

- Limited Liability Partnership

- Sole Proprietorship

The process for company incorporation Singapore is easy and gets over fast unless the application is referred to the external authority due to some reason. The private limited company is by far the most favored business structure by the business owners both, individuals and corporate.

B) For Foreign Companies

A foreign corporate can use one of the following business structures for its company registration Singapore. Singapore allows a foreign individual or company to own 100% shares in the new company. ACRA advises foreigners to hire incorporation services providers like SBS Consulting for the task.

- Subsidiary Company

- Branch Office

- Representative Office

Setting Up a Company in Singapore

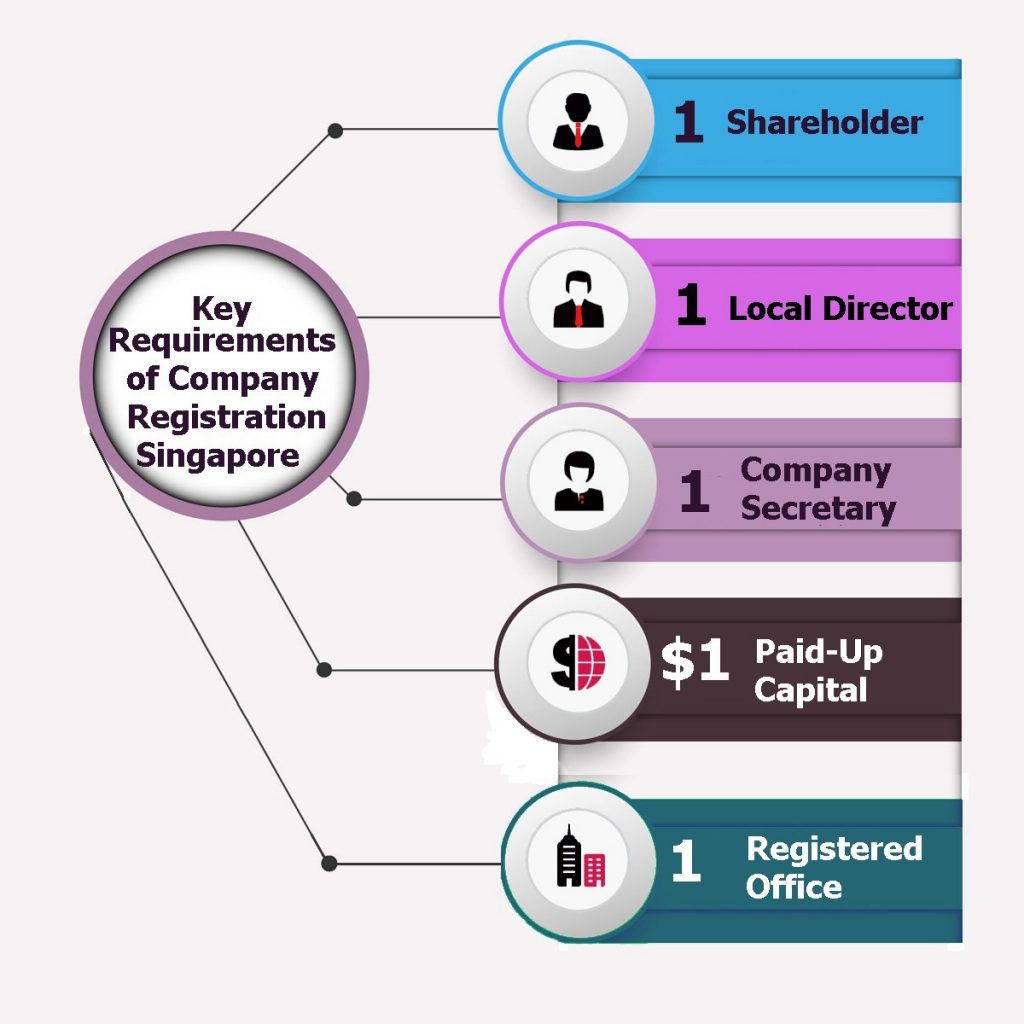

Before we could initiate the process to set up your private limited company in Singapore, you need to fulfill the following conditions:

- Registered company name

- At least 1 ordinarily resident director

- At least 1 shareholder

- At least 1 company secretary

- Minimum paid-up capital of S$1 (S$50,000 for EntrePass holders)

- Local registered address for company office

The foreigners can choose to relocate to the Singapore and act as the local directors of their companies after its incorporation. However, they need work passes such as Employment Pass or Entrepreneur Pass to work in Singapore. Alternatively, they can stay at their home but then, they must hire nominee local director services to fulfill the criteria.

Documents Required for Singapore Company Registration

Along with the application for company formation Singapore, the business owners need to submit few documents. They are listed as follows:

- Registered name of the proposed company

- Details of intended business activities

- Details of shareholders and directors

- Registered local office address

- Details of company secretary

- Memorandum and Articles of Association (M&AA) for the proposed company

- Singapore residents must submit a copy of their identity card

- Foreign entrepreneurs must submit a copy of passport, proof of overseas residential address, KYC details, a personal & business profile

- Foreign corporate must submit a copy of certificate of incorporation and company constitution

Post-Incorporation Requirements

After the successful company registration, ACRA sends an email containing the Certificate of Incorporation to its owner or the hired incorporation services provider. The message contains the Unique ID number of the new company. Our expert, on payment of required fee, can get the hard copy of the certificate of incorporation and business profile of the company from ACRA.

- SBS assists the owners of the newly minted company in opening a corporate bank account in any bank in Singapore. It is a necessity for the proper handling of the financial transactions & streamlining the cash flow of the company. It also helps, in the long run, in segregating the owner’s personal finance from that of the company’s.

- Before starting company’s business activities, the owner needs to check whether it needs any licenses or permits. The experts at SBS Consulting could apply on their behalf to the appropriate authorities and do the needful.

- We also provide assistance to register the new company with the CPF Board and top-up its account. In addition, we also assess the need to register the new business for GST (Goods and Services Tax). If it is expecting to cross S$1 million in annual turnover, then our advice is to register it for GST.

Funding Options Open to Singapore Companies

Singaporean authorities are very much interested in seeing their startups succeed. It is one of those countries that are actively supporting their innovative and creative individuals in starting with the right foot in the business arena.

Singapore has multiple small business grants, schemes, and other programs to offer to the entrepreneurs opting for Singapore company registration. It is one of the markets where the businesses can rely on lower tax rates, multiple DTA agreements, and tax benefits that are tasked with keeping their overheads low.

Grants and Schemes for the Singapore Companies

The experienced providers of Singapore accounting services advise Singapore businesses, right from the incubation period, to investigate multiple funding options. There are various schemes supported by the government agencies for the purpose.

- ACE Startups Grant

- Accreditation@IDA

- Industry track for A*STAR scholars

- Smart Nation

- IDM Jump-start and Mentor (i.JAM)

- JTC LaunchPad @ one-north

- MOOC Pilot for Data Sciences & Analytics Training

- Productivity and Innovation Credit (PIC)

- Sector Specific Accelerator (SSA) program

- Technology Enterprise Commercialisation Scheme (TECS)

- SPRING SEEDS

- Technology Incubation Scheme (TIS)

- Early Stage Venture Fund (ESVF)

- Business Improvement Fund

- Workforce Development Authority (WDA) subsidies

- Innovation & Capability Voucher

- ComCare Enterprise Fund

- Capability Development Grant

- Fast-Track Environmental and Water Technologies Incubator Scheme

- Technology Incubation Scheme (TIS)

In addition, Singapore business owners can expect financial support from the entities like Angel Investing Networks, Venture Capital Firms, Private Equity Firms, etc.

Angel Investing Networks

The term ‘Angel Investors’ covers individuals or groups that are interested in backing startups in their earlier stage. The startups, especially those having untested business model, find these individuals useful when they need quick access to finance. The following is a short-list of angel investors operating in Singapore.

- Business Angel Network South East Asia (BANSEA)

- Business Angel Scheme (BAS)

- Singapore Angel Network (SGAN)

Venture Capital Firms

The startups that do not have access to capital market choose to go to the Venture Capital firms. These are groups of investors that finance startups and small businesses that they believe are great for long-term investments. In reality, the investment may turn out to be a high-risk investment. The following is a list of venture capital firms in Singapore.

- Singtel Innov8

- KK Fund

- East Ventures

- Golden Gate Ventures

- Fenox Venture Capital

- IMJ Investment Partners

- Ardent Capital

- Jungle Ventures

- Sequoia Capital

- 500 Startups

- Life.SREDA

- Singapore Venture Capital & Private Equity Association

Private Equity Firms

Singapore businesses having a very positive bottom-line can go to these entities for the finance. These are no risk-takers, rather, they believe in backing well-established and profitable performers experiencing high-growth rate. The following is a list of such entities you can find in Singapore.

- 3V Source One Capital

- Venstar

- Navis Capital Partners

- AIF Capital

- Tael Partners

- L Capital Asia

Singapore really believes in its startups and SMEs. The authorities understand the role these entities play in keeping the unemployment rate down. It is the main reason why they support an energetic startup ecosystem. Last year, the startups raised more than S$3.5 billion in investment from the VC’s and private equity firms. There were successful IPO’s and acquisitions.

Singapore Taxation

Singapore corporate tax rate (0%-17%) is also considered as one of the most affordable. Moreover, the Singapore registered startups benefit from the tax exemption scheme specially designed to keep their overheads down in their initial days. They get full tax exemption on their chargeable income of up to S$100,000.

The existing companies also benefit under Partial Tax Exemption scheme. The dividends disbursed by the companies to their investors are tax-free because Singapore does not practice capital gain tax. The country also ranks high for the ease of paying taxes.

Singapore is a fully geared business environment that offers excellent network connectivity, extensive sea routes and reliable air links, modern infrastructure, dependable transportation system, secure environment, world-class education, etc. It is easy to see why entrepreneurs from all over the world opt for company incorporation Singapore. Indeed, the little island is a great place for doing business.